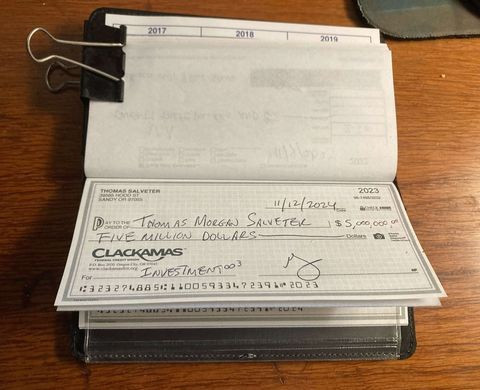

Non Linear Departure from $5,000,000.00

Aka $14 Thousand Dollars a day

Aka $14 Thousand Dollars a day

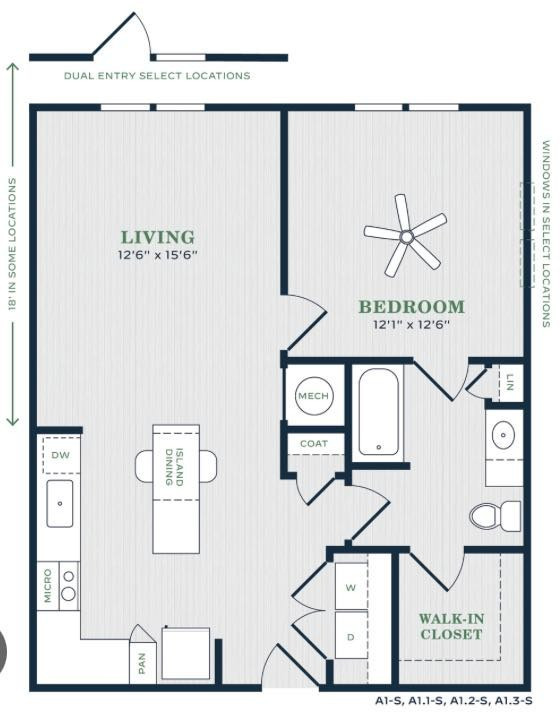

HOW TO OWN A 32 UNIT APARTMENT COMPLEX

ChatGPT said:

ChatGPT

Owning a 32-unit apartment complex can be a lucrative investment, but it also requires careful planning, financing, and management. Here’s a step-by-step guide to help you achieve that goal:

1. Understand the Market

Research Local Market Conditions: Look for areas with strong rental demand, low vacancy rates, and good potential for appreciation. Areas with universities, hospitals, or growing employment opportunities are often good candidates.

Understand the Demographics: Consider the types of renters in the area—young professionals, students, families, etc. This will help determine the best type of property and amenities.

2. Determine Your Financing Options

Owning a 32-unit apartment complex is a significant investment, so securing financing is one of the first major steps.

Assess Your Financial Situation: How much capital do you have? What’s your credit score? Will you be able to cover the down payment, closing costs, and any renovation or repair costs?

Get Pre-Approved for a Loan: You can approach traditional lenders like banks or credit unions, or consider specialized real estate lenders.

Commercial Loans: For a 32-unit building, you’ll likely need a commercial real estate loan. These typically require a larger down payment (20-30%) compared to residential loans.

FHA Loans: In some cases, you may be eligible for a government-backed FHA loan if you’re buying a multi-family property (up to 4 units). For larger buildings, you may need to explore other loan programs.

Explore Alternative Financing: Crowdfunding, private investors, or partnerships can also help you pool resources.

3. Find the Right Property

Use Online Platforms and Broker Networks: Websites like LoopNet, CREXi, or Realtor.com specialize in commercial properties. You can also work with a real estate broker who specializes in multi-family properties.

Consider Property Condition: A 32-unit apartment complex may come with significant repair or renovation needs. Determine whether the property is move-in ready or requires capital expenditures (CapEx).

Analyze the Income Potential: Review the rent roll (how much rent each tenant pays) and operating expenses. Make sure the property can generate enough rental income to cover your mortgage, taxes, insurance, and management fees.

4. Conduct Due Diligence

Before making an offer, do thorough research:

Inspect the Property: Hire professionals to assess the condition of the building’s structure, plumbing, electrical, HVAC systems, and roof.

Review Financials: Examine the current owner’s financial records, including rent collections, operating expenses, and vacancy rates. This will help you project future earnings and assess the property’s value.

Title Search: Ensure there are no outstanding liens or legal issues with the property.

Check Zoning and Regulations: Ensure that the property is zoned for multi-family use and complies with local laws (e.g., rent control, building codes).

5. Make an Offer and Negotiate

Once you've decided on a property, submit an offer based on your due diligence and the market value. Negotiation is key:

If you find issues during the inspection or financial review, use these as leverage to negotiate a lower price or request repairs.

Ensure the terms of the contract align with your financing and investment strategy.

6. Close the Deal

Hire an Attorney: Have a real estate attorney review the contract and ensure everything is in order.

Secure Insurance: Make sure you have appropriate property insurance to protect against potential risks (fire, theft, natural disasters).

Finalizing the Loan: Once the deal is structured and approved, close the loan and finalize the purchase.

7. Manage the Property

Owning and managing a 32-unit complex involves oversight of both physical and financial aspects:

Property Management: If you're not experienced in managing a large building, consider hiring a property management company. They can handle leasing, tenant issues, maintenance, and rent collection.

Tenant Screening: Use thorough background and credit checks to ensure reliable tenants. Having high-quality tenants will reduce turnover and maintain cash flow.

Budgeting and Maintenance: Track all income and expenses. Regularly inspect the property to identify maintenance needs early.

Rent Adjustments: Consider periodic rent increases to keep up with inflation and market rents, but be sure to stay within legal limits in your jurisdiction.

8. Reap the Benefits

Over time, owning a multi-unit property can generate a steady stream of income, tax deductions (e.g., depreciation), and potential for appreciation in value.

Positive Cash Flow: Ensure that the rent covers all expenses (mortgage, taxes, insurance, maintenance) with room for profit.

Tax Benefits: Owning real estate offers tax advantages, such as depreciation, interest deductions, and possible 1031 exchange opportunities if you want to sell and reinvest.

9. Consider Future Growth

As you stabilize and grow your property, look for ways to expand your portfolio:

Buy More Units: If your first 32-unit complex is successful, consider using equity from the property to fund the purchase of additional properties.

Increase Rent or Upgrade Units: Adding value through renovations can increase rental rates, boosting income and property value.

Key Considerations:

Risk Management: Multi-unit properties can be profitable, but they come with risks—vacancy rates, maintenance costs, and tenant issues. Ensure you have a good cushion in your budget to cover unexpected expenses.

Long-Term Focus: Multi-family real estate is typically a long-term investment. The value tends to appreciate over time, especially if you manage it well.

Summary Checklist:

Conduct market research and select a location.

Assess your finances and secure financing.

Search for suitable 32-unit properties.

Conduct due diligence (inspection, finances, zoning).

Negotiate and finalize the deal.

Manage the property or hire a management company.

Monitor the performance and explore growth opportunities.

With the right strategy and management, owning a 32-unit apartment complex can become a profitable venture. It’s all about making smart financial decisions, maintaining the property, and building solid tenant relationships.